Ira withdrawal tax calculator

Web Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Do Your Investments Align with Your Goals.

. Do Your Investments Align with Your Goals. Find a Dedicated Financial Advisor Now. Web Early Withdrawal Pre 59-½ Penalty Tax Exceptions and Annuities.

Find a Dedicated Financial Advisor Now. Ad Use This Calculator to Determine Your Required Minimum Distribution. Web The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Web Contributions for a given tax year can be made to a Roth IRA up until taxes are filed in April of the next year. Also you may owe income tax in addition.

Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. Automated Investing With Tax-Smart Withdrawals. Web Whenever you take money from a traditional IRA you have to pay taxes at your ordinary or marginal income tax rate.

Distributions from a Roth IRA may be subject to income taxes and in some cases the 10 penalty. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. LoginAsk is here to help you access Ira Account Withdrawal.

Web Taxes and Penalties. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Currently you can save 6000 a yearor 7000 if youre 50 or older.

Web As of 2021 if you are under the age of 59½ a withdrawal from a 401 is subject to a 10 early withdrawal penalty. Web With our IRA calculators you can determine potential tax implications calculate IRA growth and ultimately estimate how much you can save for retirement. Web Calculate your earnings and more.

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Web Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Roth IRA Distribution Details. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. 10 percent for income between 0 and.

Unfortunately there are limits to how much you can save in an IRA. Ad If you have a 500000 portfolio download your free copy of this guide now. Web This means your taxable IRA withdrawal will be taxed at 24 percent.

For married couples filing jointly the tax brackets are. If you are under 59 12. Ready To Turn Your Savings Into Income.

Web Calculate your earnings and more. Web Contribution limits. Furthermore you can find the Troubleshooting Login.

This is a quick reference guide to possible exceptions to the 10 additional penalty tax on pre-59½ distributions. Web LoginAsk is here to help you access Ira Account Withdrawal Calculator quickly and handle each specific case you encounter. Web Ira Account Withdrawal Calculator will sometimes glitch and take you a long time to try different solutions.

While long-term savings in a Roth IRA. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts. Since you took the withdrawal before you reached age 59 12 unless you met.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. You will also be required to pay normal income. Here are a few common scenarios to consider.

Direct contributions can be withdrawn tax. Web The early withdrawal penalty for a traditional or Roth individual retirement account IRA is 10 of the amount withdrawn. Web Required Minimum Distribution Calculator.

Web Ira Withdrawal Tax Rate Calculator keyword Show keyword suggestions Related keyword Domain List. This guide may be especially helpful for those with over 500K portfolios. If you withdraw money from your traditional.

Our Retirement Calculator And Planner Estimates Monthly Retirement Income And Efficient Retirement Savings S Retirement Calculator Retirement Planner Financial

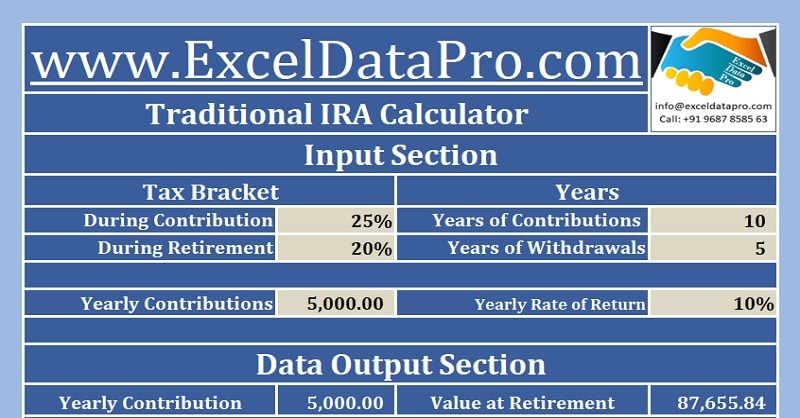

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee

Student Loan Calculator Bankrate Com Savings Calculator Miles Credit Card Credit Cards Debt

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result Fo Tax Free Savings Retirement Planning Savings Account

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result For The Opt Saving For Retirement How To Plan 401k Plan

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

Roth Ira Contribution Limits Medicare Life Health 2019 2020 Rules Roth Ira Roth Ira Contributions Ira

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Safe Withdrawal Rate For Early Retirees 401k Withdrawal Retirement Calculator How To Plan

Download Traditional Ira Calculator Excel Template Exceldatapro

The Mega Roth An Interesting Twist For Super Savers Under The Proposed New Secure Act Tax Free Savings Retirement Money Savers

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Retirement Withdrawal Calculator For Excel